"This is the news story that i had found on the media guardian website, i decided to use this story as it is a real serious issue about the decline in newspapers and how its affecting the economy and also this story needs to be looked in-depth."

It may not be sexy, but measuring how many people read newspapers - and, especially, their digital offshoots - has become hugely significant. It also means that the way the analysis is carried out has become important too. There is an obvious disparity between the readership figures provided by the National Readership Survey (NRS) and the circulation figures provided by the Audit Bureau of Circulations (ABC).

This has always been the case but it's never really troubled publishers and editors in the past. They have largely placed their faith in the "hard numbers" of sales rather than the readership totals revealed through opinion poll sampling. But they all know that things have to change because of the urgent need to paint a coherent picture of a paper's total "reach", aggregating print readership and online users, and this cannot be obtained through a straightforward audit.

I'm going to look at the methodology of audience measurement later this week, but today - with the release of the latest set of (NRS) statistics - let's consider what they tell us about the current state of the print industry. The year-long comparisons, showing the differences between readership sizes in the 12 months June 2005-June 2006 compared to those between June 2004-June 2005, provide the best glimpse of long-term trends.

Unsurprisingly, the majority of national titles have lost substantial numbers of readers, but that requires some context. Despite the generally depressing state of affairs, the total readership of the 10 national daily titles in the first six months of this year was 26.96m. That means a reasonable slice of the 47.97m estimated adult population of Britain reads a paper on a daily basis, and that figure is boosted by 2.75m reading Scottish dailies and many hundreds of thousands reading provincial mornings or evenings. So I always try to keep that in the front of my mind when analysing the increasingly poor performance of print.

The worst results recorded were for the Financial Times, down by 22% (within its UK audience); the Daily Star (-12%); the Daily Express (-11%); and the Daily Mirror (-10%). The Daily Telegraph lost 6% of its readers and the Daily Mail lost 4%, though it was still able to boast the second-largest daily readership with 5.45m regular readers. The Sun, despite a 1% drop, remained way ahead with a readership of 8.07m. Then there were the success stories: The Independent recorded a 24% increase, lifting it from 617,000 readers to 766,000; The Times went up by 3% to 1.79m, taking it within 300,000 of the Daily Telegraph, (and, incidentally, making it more popular than the Daily Star); while The Guardian increased by 1%.

The reason for the trio of successes is obvious. All of them changed format and benefited from uplifts in sales and greater public interest stimulated by publicity and increased promotional activity. It will be fascinating to see if they can maintain that upward trend over the course of the next 12 months. Somehow, I doubt it.

A similar pattern was apparent among the Sunday national titles. The two shape-changers (Independent on Sunday and Observer) recorded rises of 9% and 8% respectively. The only other paper to add extra readers was the Sunday Times (2%). All the other titles lost readers, with the Sunday Telegraph (-8%) doing worst of all. Again, the benefits of novelty and promotion will surely wear off before this year is out. What these figures reveal is that the pace of change (meaning print decline) is speeding up. Readership tends to be more volatile than circulation but that is not the case here. The same story is told by both.

The readership trends for magazines are fascinating too, confirming the vibrancy of some sectors - such as women's weeklies - and the continuing decline of others. It would seem that magazines are finding it more difficult also to attract an online following as successfully as newspapers, though we need much more evidence. It is clear, for instance, that the readers of certain specialist magazines that are bought as much for their adverts as their editorial are turning in ever greater numbers to the net. Note, for example, the slump of the car periodicals: Auto Express (-27%); Autocar (25%); Autosport (-9%); and Auto Trader (-8%). Exchange & Mart, fell by 18%, and the situation is getting worse by the month for a mag that cannot compete with online offerings.

The TV magazine market is crowded and competitive, with a variety of ups and downs reflecting shifting loyalties. The four largest all lost substantially - What's on TV (-9%), Radio Times (-6%), TV Quick (-8%), and TV Times (-10%) - while the newer Total TV Guide rose by 41% and TV Easy made its first entrance into the chart. Among the women's weeklies, Closer enjoyed a 22% increase, New! advanced by 17%, Heat rose by 10% and OK! leapt by a further 9% to boast 2.54m readers while its rival Hello! slipped back by 7% to 2.09m. The women's monthlies also revealed decline, with slight falls for Cosmo, Marie Claire, Elle and Prima, though Glamour recorded a 5% rise and Good Housekeeping eased up a little.

There was a noticeable readership decline for the overall monthly market, especially for the men's mags. Down went the market leader FHM (-14%), followed by Loaded (-19%), Maxim (-19%), Esquire (-13%) and GQ (-13%). Again, car magazines also proved less popular, as did most of the mags dedicated to sports and leisure pursuits.

In sum, these latest set of NRS results point to the continuing decline of the print market as a whole. That is not a surprise, though the scale does imply that the decline has been speeding up. But I reiterate: these measurements, despite the polling sophistication employed, no longer provide an accurate assessment of the pulling power of newspapers and magazines. Unless the industry agrees to a new form of measuring its combined print and online audience then it will not be serving itself properly. Advertisers urgently need that currency to have confidence in the future of our media brands.

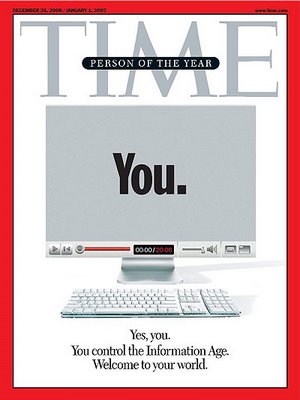

This is the front page cover of the Time magazine. This is the christmas issue and the last of the year 2006. When looking at the cover, the sophisticated, traditional looking serif typography gives the news magazine a more traditional and conservative feel, which places the audience in a traditional view and to read and view the magazine in a serious way.

This is the front page cover of the Time magazine. This is the christmas issue and the last of the year 2006. When looking at the cover, the sophisticated, traditional looking serif typography gives the news magazine a more traditional and conservative feel, which places the audience in a traditional view and to read and view the magazine in a serious way.